Raising Funds For Startup ?

Here are some ways you can raise funds for your startup:

- Bootstrapping: Starting your company using only personal savings or by generating revenue.

- Friends and Family: You can approach friends and family members for financial support.

- Angel Investors: High net worth individuals who are willing to invest in startups in exchange for equity.

- Venture Capital: Investment firms that provide funding to startups in exchange for equity.

- Crowdfunding: Raising small amounts of money from a large number of people through platforms like Kickstarter or Indiegogo.

- Grants: You can look for grants offered by government organizations or foundations to fund your startup.

- Bank Loans: Banks offer loans to startups, but typically require a solid business plan and a good credit score.

It’s important to note that each method has its own advantages and disadvantages, so it’s best to carefully consider which is the best fit for your business and goals.

- Bootstrapping :- Yes, bootstrapping is a method of starting a business without relying on external funding. It involves using personal savings and generating revenue from early customers to finance growth and cover operating expenses. Bootstrapping can be a great way to start a business because it allows you to maintain control and ownership, and reduces the risk of losing equity to outside investors. However, it may also limit the amount of capital you have available to invest in growth and can make it more difficult to scale quickly

2. Friends and Family :-

Raising funds from friends and family is a common way for entrepreneurs to get started. It’s a way to raise capital without giving up equity or incurring debt, and it can provide a strong support network for your business. However, it’s important to consider the potential consequences of mixing personal and professional relationships. If the business doesn’t succeed, it can put a strain on your personal relationships, and if it does succeed, it can create expectations and obligations that you may not be prepared to handle.

To avoid these issues, it’s important to treat friends and family investments as you would any other investment. This means having a clear and professional business plan, setting realistic expectations for returns, and following through on your commitments. You may also want to consider putting the terms of the investment in writing, to avoid misunderstandings down the road.

3. Angel Investors :-

Angel investors are high net worth individuals who invest their own money into startup companies. They typically invest in exchange for equity in the company and are often involved in mentoring and advising the entrepreneur. Angel investors can provide valuable support and resources beyond just financing, making them an attractive option for many startups.

However, it’s important to note that angel investors often have high expectations for returns and may want a significant say in the direction and decisions of the company. It’s also important to thoroughly research and vet potential angel investors to ensure a good fit for your company and goals.

Raising money from angel investors typically requires a strong business plan, a well-defined target market, and a clear understanding of how you will generate revenue and achieve profitability. You may also need to be prepared to give up a portion of ownership in your company.

4. Venture Capital :-

Venture capital (VC) is a type of private equity financing provided by investment firms or individual investors to startups and early-stage companies that have high growth potential. VCs typically invest in companies that have a proven product or service, a scalable business model, and a talented management team.

VC firms typically provide large sums of capital in exchange for an ownership stake in the company, usually in the form of preferred stock. This means that in addition to receiving funding, startups also benefit from the expertise, networks, and resources of their VC investors.

However, the trade-off for this capital and support is that startups must give up a portion of equity and control of the company. VCs typically take a hands-on approach and expect to have a seat on the board of directors and regular updates on the company’s progress.

VC funding is typically sought by startups that need significant capital to finance rapid growth and scale their operations, but it is not suitable for all businesses. Startups should carefully consider the terms and conditions of a VC investment before accepting it.

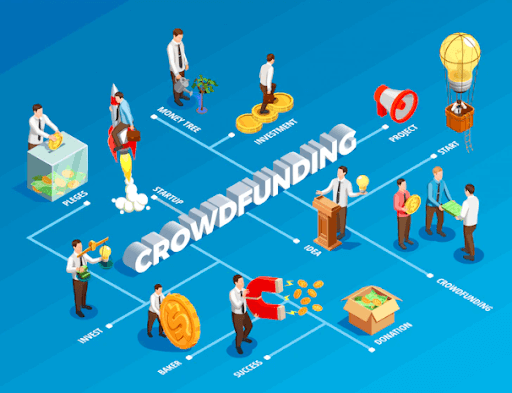

5.Crowdfunding:-

Crowdfunding is a method of raising funds by soliciting small contributions from a large number of people, typically via the internet. There are several types of crowdfunding, including rewards-based crowdfunding, where backers receive a reward for their contribution; equity crowdfunding, where backers receive a stake in the company; and debt crowdfunding, where backers are loaned money and expect to receive their principal back with interest.

Crowdfunding can be a quick and efficient way to raise capital, and it also provides valuable feedback and market validation for your business. However, it can be challenging to reach your funding goal, and there is no guarantee that you will reach it. Additionally, you may need to offer rewards or give up equity, which can impact your ownership and control of the business.

6. Grants :-

Grants are a type of funding that do not need to be repaid, unlike loans. They are often provided by government agencies, non-profits, and foundations to support specific projects or initiatives. Startups in certain industries, such as technology or social entrepreneurship, may be eligible for grants to support research and development, market validation, and other critical early-stage activities.

To find grants that are relevant to your startup, you can start by searching online for funding opportunities or visiting the websites of government agencies and foundations that provide grants. You may also be able to connect with local economic development organizations or industry associations that can provide information about grants and other funding opportunities.

It’s important to note that competition for grants can be intense and the application process can be time-consuming. In addition, many grants have strict criteria and requirements that must be met, so it’s important to carefully research and understand the requirements before applying.

7. Bank Loans :-

Yes, bank loans are another option for financing a startup. Banks may offer loans to startups, but the terms and requirements can vary depending on the lender and the specific loan product. Typically, a startup will need to provide a detailed business plan,